ZATCA Phase 2 (Integration Phase) mandates that selected businesses in Saudi Arabia fully integrate their systems with ZATCA’s Fatoora platform for real-time invoice clearance. This phase is not voluntary and requires direct API integration to transmit e-invoices within seconds of issuance.

Crucial Clarification from Real Conversations:

A common point of confusion is determining if and when a business must comply. ZATCA will notify you directly via your taxpayer portal if you are included in a Phase 2 wave. While initial waves targeted large taxpayers (historically those with annual revenue > SAR 500M), the threshold is lowering, and all VAT-registered businesses should prepare. If you haven’t received a notification, you are likely still in Phase 1, but must ensure your software is Phase-2 ready for a smooth transition when your time comes.

Full Blog Post

The Saudi Arabian tax landscape is evolving rapidly, and for businesses, staying ahead of compliance requirements is crucial. Having navigated the initial wave of e-invoicing with ZATCA Phase 1 (Generation Phase), it’s time to focus on the next, more complex stage: ZATCA Phase 2, the Integration Phase.

Based on real conversations with business owners, there’s significant confusion around eligibility and requirements. This updated guide incorporates those frequently asked questions to give you a clearer path forward.

Part 1: Understanding ZATCA Phase 2

Phase 2, also known as the Integration or Clearance Phase, requires taxpayers to integrate their e-invoicing solutions directly with ZATCA’s Fatoora platform. The core principle is clearance: every tax invoice and simplified invoice (over a specific threshold) must be reported to and validated by ZATCA in near-real-time.

Part 2: The Most Common Question – “Am I in Phase 1 or Phase 2?”

This is the number one concern for businesses. Let’s break down the answer:

- The Official Rule: ZATCA will formally notify you. You will receive a direct notification in your ZATCA/Fatoora taxpayer portal with your specific integration deadline, typically 6 months in advance.

- The Revenue Threshold (A Guideline, Not a Guarantee): The roll-out has been based on annual taxable revenue. The first waves included the largest taxpayers. While there is no universal public “cut-off,” in practice, businesses with annual revenue below a certain threshold (e.g., SAR 3-5 million) have generally remained in Phase 1. However, this threshold is decreasing over time.

- The Critical Takeaway: If you are newly VAT-registered or a small-to-medium business and have not received a notification, you are currently operating under Phase 1 rules. Your obligation is to generate compliant invoices with a QR code. You do not need to submit invoices to ZATCA yet.

- Changing Business Under the Same CR: If you change your business activity under the same Commercial Registration (CR) number, your Phase 2 eligibility is still based on the taxable revenue and formal notification from ZATCA. Your VAT charging obligations are separate from your Phase status.

Actionable Advice: Don’t wait in uncertainty. Log into your ZATCA portal now to check for any notifications. Simultaneously, assume you will need to comply with Phase 2 in the future and prepare your systems accordingly.

Key Differences: Phase 1 vs. Phase 2

| Feature | Phase 1 (Generation) | Phase 2 (Integration) |

|---|---|---|

| Core Requirement | Generate invoices with specific fields & a QR code. | Integrate systems and transmit invoices to ZATCA. |

| QR Code | Contained basic seller/Tax info. | Must contain a cryptographic stamp and UUID from ZATCA. |

| Reporting to ZATCA | Not Required. | Mandatory, real-time clearance via API. |

| Invoice Format | PDF/Word was acceptable for the customer copy. | XML (UBL format) is mandatory for transmission to ZATCA. |

| Compliance Check | Seller’s responsibility. | ZATCA validates and provides a clearance stamp. |

The 4 Pillars of Phase 2 Compliance

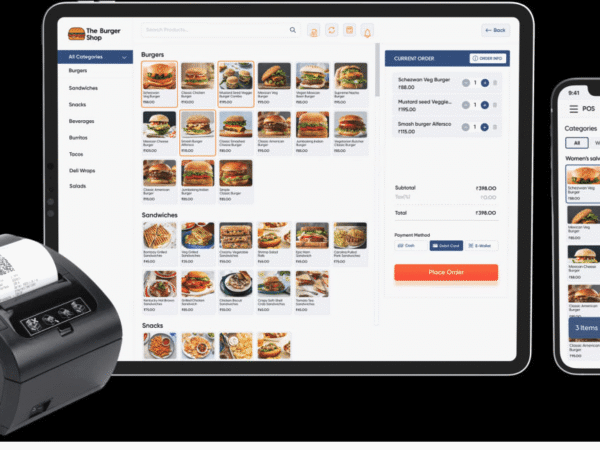

- System Integration: Your invoicing software must connect to ZATCA’s API gateway. This requires technical development or partnering with a ZATCA-certified Solution Provider.

- Invoice Clearance: For each invoice, your system sends XML data to ZATCA, which validates it and returns a Unique UUID (Universally Unique Identifier) and a cryptographic stamp. This stamp is embedded in the QR code on the final invoice.

- Data Standards: Invoices must be structured in a specific XML format based on the PEPPOL BIS Billing 3.0 standard (UBL).

- Archiving: You must securely archive both the human-readable invoice (PDF) and the signed XML file for audit purposes.

Your Action Plan: From Inquiry to Compliance

- Determine Your Status: Check your ZATCA portal for an official notification. If you have one, note your deadline. If not, you are in Phase 1.

- Choose Future-Proof Software NOW: This is the most critical step. Whether in Phase 1 or 2, your software must be Phase-2 capable. Ask your provider: “Is your software directly linked with ZATCA for Phase 2 clearance, and can you enable it for us when we are notified?” A qualified provider (like the one in the conversation) should be able to go live with your integration in a short timeframe (e.g., 7-10 days).

- Don’t Panic, But Prepare: If you’re in Phase 1, use this time wisely. Ensure your current Phase 1 invoicing is flawless. Work with your provider to understand the XML/UBL format and get a demo of their Phase 2 module.

- Test Upon Notification: Once notified, immediately begin testing in ZATCA’s sandbox environment with your provider to ensure a smooth transition before the live deadline.

Common Myths and Clarifications (From Your Questions)

- Myth: “If I issue VAT invoices, I must be in Phase 2.”

- Truth: All VAT-registered businesses must issue VAT-compliant invoices. Phase 2 is specifically about transmitting those invoices to ZATCA in real-time. These are separate requirements.

- Myth: “I can check a public list to see if I’m in Phase 2.”

- Truth: Notification is direct and individual. There is no single public list for all waves.

- Myth: “Implementing Phase 2 software will take months.”

- Truth: With a pre-built, certified solution, the technical integration can be very swift (days or weeks). The six-month notification period is for you to complete this process and testing.

Conclusion: The Safe Path Forward

ZATCA Phase 2 is an inevitable step for all businesses in KSA. The conversation highlighted a universal journey: from confusion, to clarity, to the need for a reliable software partner.

The strategy is simple:

- Verify your status via the ZATCA portal.

- Procure a ZATCA Phase-2 ready and certified solution.

- Prepare your team and processes.

- Execute swiftly when your notification arrives.

By treating Phase 2 readiness as a key part of your business infrastructure today, you turn a future compliance mandate into a seamless, stress-free upgrade, ensuring your business remains agile and fully compliant in Saudi Arabia’s dynamic digital economy.

Your Next Step: Visit the official ZATCA e-invoicing portal and immediately contact your software provider to confirm their Phase 2 capabilities and certification status.

then 'Add to home screen'

then 'Add to home screen' then 'Add to home screen'

then 'Add to home screen'