Saudi businesses keep hearing about ZATCA Phase-2, integration, links, portals, thresholds… and suddenly everyone is nervous 😅

So let’s break it down the way business owners actually ask — simple, honest, and practical.

Q1: Is my accounting or ERP software required to be directly linked with ZATCA?

Short answer:

👉 Only if you are officially in ZATCA Phase-2.

Explanation:

- In Phase-1, your system must generate compliant electronic invoices (QR code, VAT details, etc.)

- In Phase-2, your system must integrate directly with ZATCA’s platform for invoice clearance and reporting.

ZATCA itself decides who enters Phase-2 and notifies the business officially.

Q2: How can I check whether my business is in Phase-1 or Phase-2?

This is one of the most common questions — and the answer is very important.

✔️ You do NOT self-declare Phase-2

✔️ ZATCA officially notifies you through their portal

If you haven’t received:

- An official ZATCA notification

- A Phase-2 integration deadline

- Access details or instructions in your ZATCA portal

👉 Then you are still in Phase-1

Q3: Does annual sales amount decide Phase-1 or Phase-2?

Indirectly — yes, but with conditions.

General understanding:

- Historically, Phase-2 started with large businesses

- Thresholds began around SAR 4 million+ annual revenue

- ZATCA is gradually lowering thresholds to include more businesses over time

⚠️ Important:

Even if your revenue grows, Phase-2 only applies after ZATCA officially flags you

Q4: We are a new business. Which phase applies to us?

✅ Almost always Phase-1

New businesses:

- Start with Phase-1 compliance

- Issue VAT invoices normally (if VAT-registered)

- Do NOT submit invoices to ZATCA in real time

ZATCA evaluates your activity after you start operating, not before.

Q5: We changed business activity under the same CR number. Does that affect ZATCA phase?

Great question — and very realistic.

Answer:

Changing business activity under the same CR does not automatically move you to Phase-2.

What matters:

- Actual reported revenue

- VAT registration status

- ZATCA’s internal assessment

If your previous business was closed and revenue didn’t meet VAT thresholds, ZATCA will reassess based on the new activity and future sales, not history alone.

Q6: If we issue VAT invoices regularly, does that mean we are Phase-2?

❌ No. This is a common misunderstanding.

- Issuing VAT invoices is mandatory for all VAT-registered businesses

- Phase-2 is about technical system integration, not VAT charging

You can:

✔️ Charge VAT

✔️ Issue compliant invoices

✔️ Submit VAT returns

…while still being Phase-1

Q7: Will ZATCA automatically connect our system once we reach a certain sales amount?

Nope 😄 ZATCA is not a mind reader.

Here’s how it actually works:

- You operate normally (Phase-1)

- Revenue grows

- ZATCA reviews eligible taxpayers

- ZATCA officially notifies selected businesses

- You receive integration instructions & deadline

- Phase-2 becomes mandatory

Until step 4 happens → you’re safe in Phase-1

Q8: Is it risky to prepare Phase-2 early?

Actually… it’s the smartest move 😉

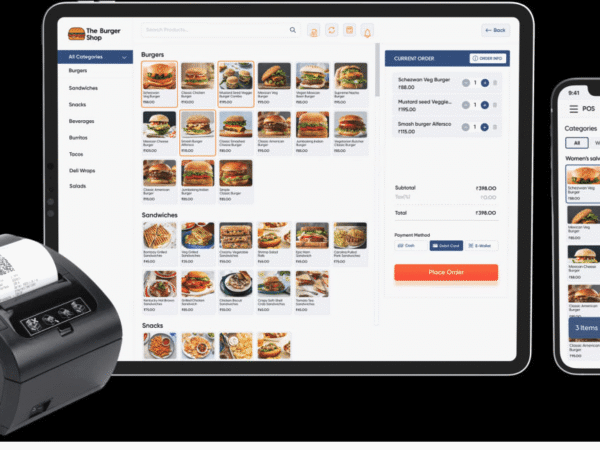

Many professional businesses choose systems that:

- Are Phase-1 compliant today

- Are Phase-2 ready in the background

So when ZATCA sends the notification:

👉 No panic

👉 No system change

👉 No compliance rush

Just activation.

Q9: How fast can Phase-2 be activated once ZATCA notifies us?

If your software is already Phase-2 ready, activation is usually:

⏱️ 5–7 working days

This includes:

- ZATCA credential setup

- Sandbox testing

- Production integration

- Clearance flow validation

Q10: What is the safest recommendation for small and growing businesses?

💡 The “Safe Move” Strategy

- Stay fully Phase-1 compliant

- Use software that is Phase-2 ready

- Monitor official ZATCA notifications only

- Avoid panic decisions based on rumors or WhatsApp myths 😅

Final Thoughts (Boss-Level Summary 🧠)

- Phase-2 is mandatory only when ZATCA says so

- Revenue alone does not automatically trigger integration

- VAT charging ≠ Phase-2

- Smart businesses prepare quietly and activate when required

If your ERP or accounting system already supports both phases, you’re playing chess — not checkers ♟️

then 'Add to home screen'

then 'Add to home screen' then 'Add to home screen'

then 'Add to home screen'